A Notice of Intent to Levy IRS is one of the most serious warnings the Internal Revenue Service (IRS) can send to a taxpayer. It means the IRS is preparing to take money directly from your wages or bank accounts or even seize your property if outstanding tax debts are not resolved quickly.

In 2025, these notices became more frequent as the agency increased its efforts to collect unpaid tax bills. If you have received this notice, it is crucial to act quickly. This guide will help you understand what actions you need to take if you receive a notice.

Understanding the IRS Final Notice of Intent to Levy

A Notice of Intent to Levy IRS is the agency’s way of telling you, in writing, that time has run out. The notice informs you that the agency plans to seize property such as wages, bank deposits, and, in extreme cases, physical assets. Before doing this, the IRS must issue the notice in writing and give you a set timeframe to respond.

When and Why Does the IRS Issue a Notice of Intent to Levy?

The IRS typically sends this notice when:

- Repeated reminders and billing letters have been ignored.

- A taxpayer fails to set up a payment plan or make arrangements.

- A certified IRS tax levy notice has already gone out, and the debt remains unpaid.

In many cases, a tax levy may already be recorded by the time this letter arrives. This is the IRS’s way of protecting its right to collect by legally tying your debt to your property. If ignored, the letter moves quickly to classified enforcement actions.

What Is the IRS Final Notice of Intent to Levy?

The IRS final notice of intent to levy sample is the last letter you’ll get before the IRS takes action. Unlike earlier notices, this one makes it clear that the IRS has exhausted its patience. By law, the IRS can’t issue a levy until at least 30 days have passed since sending this final notice. Once that timeframe lapses, collection steps, including garnishments and bank account seizures, can start.

What Happens After Receiving a Final Notice?

Failure to respond to a final notice results in immediate collection steps such as:

- Wage garnishment allows the IRS to pull money directly from your paycheck.

- Bank account levies, where funds in your checking or savings accounts are frozen and withdrawn.

- IRS property liens prevent selling or refinancing a home until your tax debt is addressed.

That’s why the final notice is highly important; it’s the last safeguard before you lose control of your finances.

Received a property seizure notice? Read: How to Handle an IRS Seize Property Notice

IRS Final Notice of Intent to Levy Components

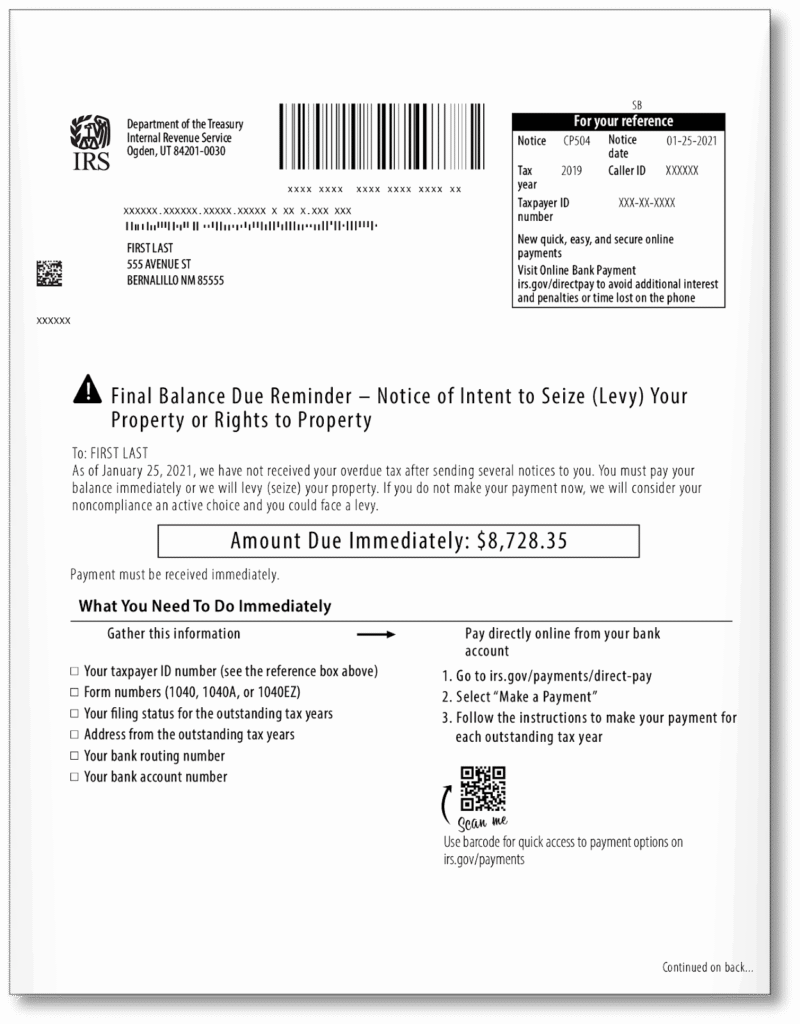

Seeing an IRS final notice of intent to levy sample helps taxpayers know exactly what information to look for. While each letter may vary slightly,the layout typically includes the following components:

Key Components of an IRS Final Notice of Intent to Levy

To respond effectively, you first need to recognize the critical elements included in an IRS Final Notice of Intent to Levy.

- The taxpayer’s personal details, including name, address, and tax ID reference.

- Amount owed, including penalties and daily interest.

- The IRS’s specific intent is whether to wage garnishment, property seizure, or bank levy.

- You have the right to a Collection Due Process hearing (CDP) within 30 days.

- The deadline by which you must act.

Recognizing these features helps you understand the seriousness of the letter.

What Actions to Take Upon Receiving a Final Notice

Receiving a final notice from the IRS can be stressful, but acting quickly is crucial to protect your finances and avoid further penalties. Here’s what you should do:

- Call the IRS immediately to set up a payment plan, such as an installment agreement.

- Submit an Offer in Compromise (OIC) to potentially settle for less than you owe if paying in full is not possible.

- Request a hearing by filing IRS Form 12153 if you believe the notice was issued unfairly or in error.

Delaying means forfeiting these options, and once seizures start, fixing the situation becomes more stressful.

How to Respond to a Notice of Intent to Levy IRS

If you receive a Notice of Intent to Levy IRS, do not panic, but don’t ignore it either. The IRS offers multiple ways to deal with the issue before collections start.

Options for Responding to an IRS Notice of Intent to Levy

Once you understand the notice, it’s time to explore your options for responding and potentially stopping the levy before it starts.

- Request a Payment Plan: Under an installment agreement, you will be paying in installments every month on your tax

- Offer in Compromise (OIC): An Offer in Compromise lets you settle your debt for less than what you owe if you demonstrate financial hardship.

- Currently Not Collectable Status: This is when you can prove that you can no longer afford simple living expenses, and the IRS can hold collections.

How to File an Appeal if You Disagree with the Levy

If you believe the tax debt is inaccurate or unfair:

- File IRS Form 12153 and request a Collection Due Process Hearing (CDP).

Provide evidence of errors, hardship, or reasons the levy should not go forward. - Consider hiring a tax resolution specialist to represent you.

Professional guidance helps ensure deadlines and requirements are met properly, minimizing the risk of collections moving forward during the appeal.

Consequences of Ignoring a Notice of Intent to Levy

Not responding to an IRS levy notice has harsh outcomes that can extend far beyond an unpaid balance. Once enforceable actions start, the IRS becomes aggressive in collecting its debt.

Wage Garnishments and Bank Levies

The IRS has legal authority to redirect money directly from your paycheck. In most cases, they leave only a limited income for living expenses. Bank account levies freeze access to your accounts and pull all eligible funds out until the balance owed is met.

Asset Seizure and Liens on Property

Beyond wages and bank accounts, the following assets are at risk:

- Vehicles

- Homes

- Business inventory and equipment

- Rental property income

Additionally, an IRS lien ties your tax debt to your property’s title, making it impossible to refinance or sell without first resolving the tax issue.

Preventing and Managing an IRS Notice of Intent to Levy

Receiving a Notice of Intent to Levy from the IRS is extremely serious, but it doesn’t mean you’re out of options. The best way to manage these situations is to act quickly, set up agreements, and, where needed, get professional support.

Tax professional Tina Hall and our team at Hall’s IRS can help navigate IRS collections, negotiate with the agency, and protect your assets. Whether you need an instalment plan, an appeal, or help preparing an Offer in Compromise, acting quickly prevents lasting damage.

FAQs

Q1. How long must the IRS give you to respond to a Notice of Intent to Levy?

The IRS also cannot start levy proceedings until 30 days after the date on the notice. At that time, he/she can pay his/her debt, request to pay in installments, or appeal. It is noteworthy that action must be taken at this period in order to guard against the imposition of wages or the levy of the bank account.

Q2. Can an IRS levy be avoided once made?

Yes, but this is harder when the levy is operating. The taxes are subject to appeal by the demand of a Collection Due Process hearing within 30 days. The levy may also be discharged or suspended through a payment arrangement, or if one is financially strained.

Q3. What occurs when the IRS provides me with a final notice of intent to levy?

If you want to pay in installments or by an installment agreement, immediately contact the IRS to agree. You can also want to pay the debt under an Offer in Compromise. To make sure that your property is not at risk, you may want to hire the services of a tax specialist and find the most reasonable version of a solution.

Q4. Is the IRS levy notice appealable?

Yes, you shall file the IRS Form 12153 as per the notice received within 30 days. In this form, a hearing of a Collection Due Process is required, where your case is held pending the consideration of your case. It wastes time to quarrel with the debt or to work out a payment programme.

Q5. What are the IRS allowable assets?

IRS can have the wages garnished by taking away part of your income. They have the ability to charge fines on your bank accounts and embezzle money. Another power bestowed on the IRS is the seizure of real estate, cars, and, in some cases, business properties. They are able to create mortgages that hinder the selling or refinancing of property.