Getting audited by the IRS might seem scary, but it’s actually quite common. Most audits happen by random chance, computer checks, or because something in your tax return raised a flag. The best way to stay calm is to be prepared. An IRS audit checklist is your simple guide to getting organized fast. When you have your documents ready, you’ll save time, protect your money, and face the audit with confidence.

Understanding Why IRS Audits Happen & What to Expect

In 2025, the IRS is using modern software and artificial intelligence to spot discrepancies even faster, making it more important than ever to ensure your tax documents are accurate. Getting selected for an audit doesn’t automatically mean you’ve made a mistake, sometimes it’s just the luck of the draw. The IRS will send a formal letter outlining the audit process, which includes back-and-forth communication and a review of your documents.

Common IRS Audit Triggers You Can Avoid

Some audit triggers are unavoidable, but many can be avoided with careful planning and attention to detail. In 2025, the biggest audit triggers include:

- Reporting large discrepancies in income (for example, mismatches on W-2s and 1099s)

- Claiming deductions that seem excessive for your income or profession

- Not reporting digital payments (like those from PayPal or Venmo) that are now sent directly to the IRS

- Payroll and employment tax filing errors for business owners

- Multiple years of simple mistakes (typos, math errors, or missing information)

If you find yourself in a higher income bracket (especially over $400,000), pay extra attention to the details since audits tend to focus more on this group. An IRS audit checklist helps you spot these triggers before you file, reducing your risk right from the start.

Types of IRS Audits and What They Mean

Knowing the type of audit you’re facing can help you prepare:

- Correspondence Audit: The simplest kind. You’ll get a letter requesting clarification or additional paperwork for specific items. Most audits take this form.

- Office Audit: You’re asked to bring documents to a local IRS office for review.

- Field Audit: The IRS visits your home or business. These are rare but cover a wide variety of documents, usually for businesses or complex tax situations.

Regardless of type, having a well-prepared IRS audit checklist and your records in order will help you feel in control through the process.

Also Read: Notice of Intent to Seize Levy Your Property!

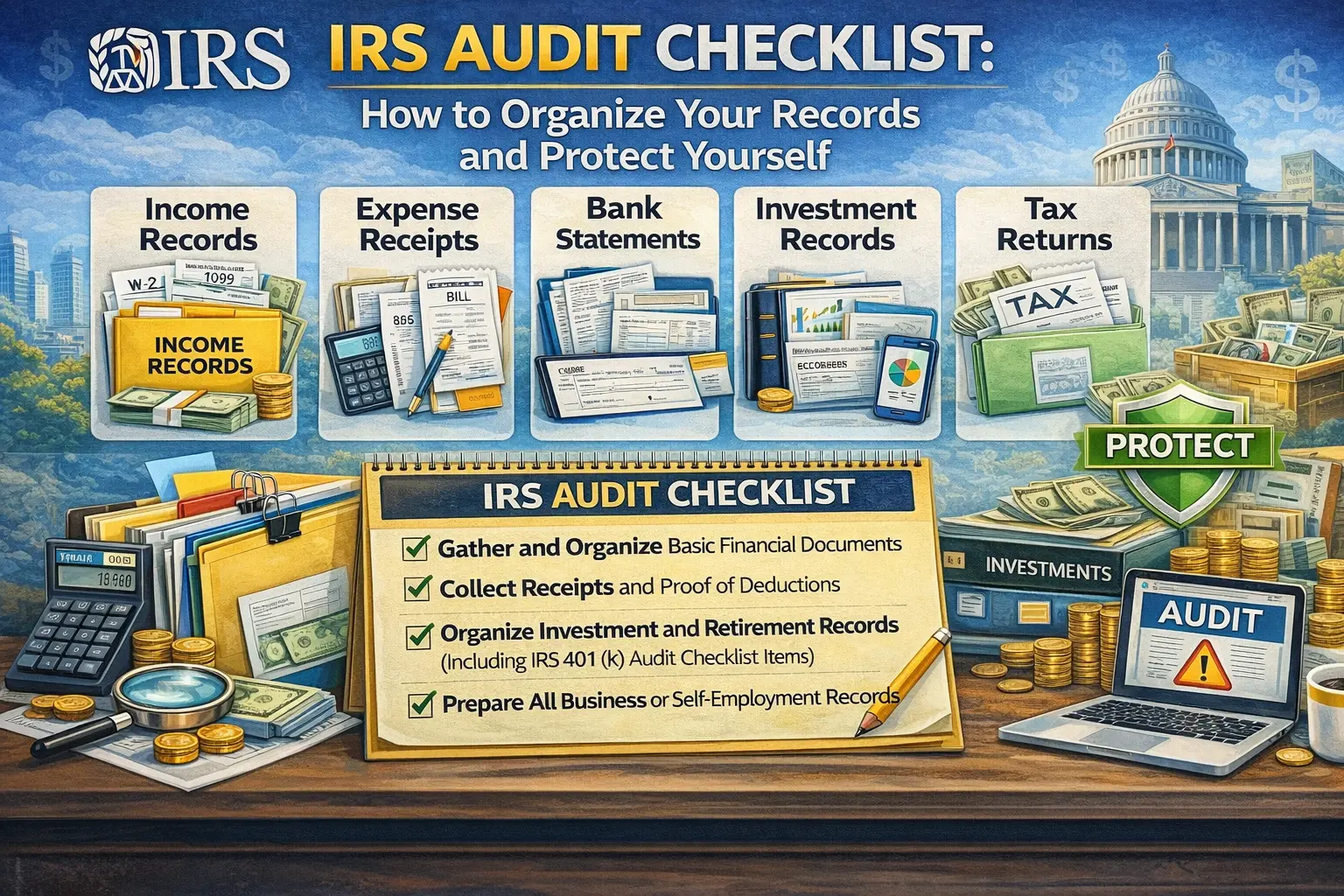

Preparing for an IRS Audit Checklist: Your Step-by-Step Guide

To help you stay on track throughout your audit preparation, here’s a detailed, step-by-step IRS audit checklist to gather and organize the key documents the IRS will want to see.

Gather and Organize Basic Financial Documents

Start with the essentials, such as tax returns from at least the past three years, your W-2s, 1099s, and all bank statements that back up the income you reported. Make sure all numbers match your filed return. For businesses, include profit and loss statements and invoices. Many Swainsboro residents find that creating both paper and digital folders by year and document type makes everything easy to find at a moment’s notice.

Collect Receipts and Proof of Deductions

Every deduction you claim from work expenses to charitable donations needs proof. Organize each receipt, invoice, and statement by category (medical, business, home office, donations, etc.), and keep them handy. If you gave a large donation, have the official acknowledgment letter ready. For home office deductions, maintain a detailed log, not just a calendar entry.

Organize Investment and Retirement Records (Including IRS 401 (k) Audit Checklist Items)

Regarding the investments, accumulate brokerage statements, annual summaries, and documentation to indicate the gains or losses made in capital. In the case of retirement accounts, such as 401(k)s, make a special folder with:

- The plan amendments and 401(k) plan agreement.

- Current Summary Plan Description (SPD)

- Compliance test results

- Form 5500 filings

- Histories of deposits, loans, or withdrawals.

- Documents of appropriate withholding of payroll on employee and employer payments.

Having all these records in one place makes your IRS 401 (k) audit checklist very fast to fill in and quick to submit in case the IRS knocks on your door.

Prepare All Business or Self-Employment Records

If you’re self-employed or a business owner, the IRS will want to see:

- Every invoice you issued and bill you paid

- Expense receipts, from office supplies to travel and marketing

- Payroll records and evidence of payroll tax payments

- Mileage logs for business vehicles

A handy tip: Reconciling your bank and credit card statements monthly ensures nothing’s missing if an audit occurs.

Keep Employment, Insurance & Other Relevant Docs Ready

Be sure to include documents such as:

- Employment agreement or even offer letters.

- Evidence of health, liability, and property insurance.

- Loan contracts, lease contracts, or other contracts.

- Any legal business with your pocket or taxes.

Periodically checking your records and completing your checklist may save you the last-minute searching until you are under the stress of an audit.

Explore: IRS Hardship Relief Program

Special Focus: IRS 401 (k) Audit Checklist Items

2025 brought several changes to retirement plan audits. New rules, such as automatic enrollment and enhanced catch-up contributions, mean even more thorough reviews for 401 (k) plans. Here’s what employers and employees should have ready:

- Plan documents, amendments, and the original adoption agreement

- Summary Plan Descriptions and Summary of Material Modifications

- Non-discrimination and coverage test results

- Annual reports; Schedule H/I, Form 5500, SOC reports from plan service providers

- Participant and contribution records, including evidence of match calculations and payroll deductions

- Documentation for 401 (k) loans or hardship withdrawals

- Committee meeting minutes regarding plan oversight and compliance

- Proof of a fidelity bond to protect assets from fraud or dishonesty.

Missing even one piece can delay the audit and possibly trigger penalties, so double-check these items annually with your administrator.

Explore: Does Offer in Compromise Affect Credit?

Protecting Yourself: Pro Tips for a Smooth IRS Audit Experience

A successful IRS audit experience depends on staying organized, responding with care, and knowing when to bring in expert help.

Respond to IRS Letters Promptly & Accurately

Always answer IRS requests within the stated deadline and double-check your response, which should be correct and complete. If you need extra time, the IRS is often willing to grant a reasonable extension if you ask early.

Double-Check All Documents Before Submission

Mistakes, mismatches, or missing pages can complicate things. Review your documents (or ask your accountant) before you send anything, or consult your accountant before submitting anything to avoid any issues later on.

Document Everything in Writing

If you speak with an IRS agent by phone, write down the date, the name of the person you talked to, and the key details. Save email or mail correspondence in a folder to track your responses.

When to Seek Professional Representation

Hire a tax professional like Tina Hall, an IRS Tax Resolution Specialist, if:

- You’re unsure why you’re being audited

- The audit is complex (large deductions, business income, retirement plans)

- You don’t feel comfortable speaking directly to the IRS.

A professional can speak for you, help you avoid mistakes, and even appeal if you disagree with the IRS’s findings.

Post-Audit: Keeping Your Records Organized for Future Safety

Once your audit is finished, keep your files handy for now, don’t put them away just yet. The IRS can revisit previous returns for up to three years, sometimes longer, if it discovers major issues. Keep your paper and digital files organized by year, client, or category. Accounting tools and secure cloud file storage make this easier than ever. Set a calendar reminder to review and update your audit checklist every tax season, so you’re never caught off guard.

Conclusion

Starting with an IRS audit checklist makes handling an IRS audit much easier and keeps your finances safe. If you keep your records organized, avoid audit red flags, and know when to seek professional help, then you’ll be prepared for any IRS inquiry. Simple organization today brings less stress and more peace of mind tomorrow.

Simplify your taxes with expert guidance today!

FAQs

Q1.What are the most often requested documents when auditing by the IRS?

In the case that you are a company owner or self-employed, the audits by the IRS often require duplication of recent tax returns, income statements (including W-2s and 1099s), bank and brokerage statements, receipts of deductions of value (including charitable gifts or medical expenses), and business records. The IRS may also request to view canceled checks, loan agreements, legal documents, logs of travel, mileage, or any other form of activity to duplicate the verification of what you reported to them.

Q2.How far does the IRS audit your returns?

The normal time frame for the process of an IRS audit is three years after you have completed registering your tax form. Nevertheless, when the IRS feels like the mistake made is of a substantial nature, like not reporting income by more than 25% then the audit period may take up to six years. Time is not imposed in rare cases when a suspected fraud obligation or tax evasion is involved.

Q3.How do I make digital and paper records orderly during an audit?

The most efficient way is to have a year and category folder of both electronic and paper records. The physical documents are to be placed in labeled binders or envelopes, whereas digital files are to be uploaded to a cloud backup service or encrypted on external hard disks. Scan major paper originals, e.g., signed contracts or checks, and save as a digital copy. Periodically transfer digital records in order to reduce loss or damage over time.

Q4.What in case I am unable to locate a document that the IRS requires?

If you can not find a document required by the IRS, then take immediate action by contacting them about what has happened and the reason why you do not have the document. Get copies of your original documents from banks or employers, and be ready to show any other evidence to support your tax returns.

Q5. What duration do you have to keep records following an IRS audit?

Once you have been audited by the IRS, you are advised to retain your tax records at least three years after the year in which you submitted your tax return. In case you understated the income by over 25 years, retain them for over 6 years. In bad debt or worthless security claims, retain records of seven years. In case you have not filed a return or made a false return, maintain records permanently.