Are you dealing with unpaid medical bills? If yes, we understand how stressful it can be, and the fear of wage garnishment can make the situation even worse.

Have you ever thought, can medical debt collectors garnish wages? Well, the answer depends on specific legal and financial factors, including wage garnishment laws and court involvement.

To protect your income and maintain financial stability, you need to understand your wage garnishment rights. Knowing how the debt collection process works and looking for legal debt solutions can help you avoid medical debt garnishment.

In this blog, we will break down everything you need to know, from medical debt protection strategies to court-ordered wage garnishment, so you can be ready and take the right steps to protect your money.

Latest Facts and News About Medical Debt Garnishment

Before we look into the legal side of wage garnishment, it helps to understand how common and serious medical debt has become in the U.S. today.

- Rising medical debt: Medical debt affects millions of Americans annually. It is the largest type of debt in collection, with around 100 million Americans dealing with it. Even larger than most debt from credit cards, utilities, and auto loans. A 2025 study showed that around 9% of Americans owe more than $250 for healthcare costs.

- Policy updates: In January 2025, the Consumer Financial Protection Bureau (CFPB) announced a rule that removes $49 billion in unpaid medical bills from credit reports. States have leveraged American Rescue Plan funds to clear over $1 billion in medical debt for 750,000 people. By 2026, these efforts will help eliminate up to $7 billion in debt for nearly 3 million people.

- Consumer protection laws: The Fair Debt Collection Practices Act (FDCPA) protects consumers from abusive and unfair collection practices. In addition, recent regulations by the Consumer Financial Protection Bureau (CFPB) removed medical bills under $500 or less than a year old from credit reports.

What Is Wage Garnishment?

Wage garnishment is a legal process where a court orders the employer to take a portion of your wages to pay off a debt. This money is sent to the creditor directly until the debt is paid in full.

The wage garnishment process

If your medical debt ends up in court, here’s what the legal journey typically looks like:

- Court judgment: The garnishment process begins when a creditor sues a debtor. If the creditor wins the case, the court will require the debtor to pay up.

- Garnishment order: After this judgment, the court sends the garnishment order to the debtor’s employer or bank, specifying the amounts to be deducted.

- Employer compliance: Upon receiving the notice, the employer deducts the garnished portion from the debtor’s paycheck and sends it to the creditor.

- Notification: You’ll be informed about the garnishment, including the amount to be deducted and the creditor’s details.

- Duration: This garnishment continues until the debt is fully paid or if the debtor challenges or changes the repayment terms.

Common reasons for wage garnishment

Wage garnishment can happen due to different types of debts. Here are the common reasons:

| Reason for Wage Garnishment | Explanation |

| Medical Debt | If you fail to pay your medical bills, they can sue you, and if they win, they may garnish your wages to pay off the debt. |

| Credit Card Debt | If you don’t pay your credit card bills, a court may order wage garnishment to collect the debt. |

| Unpaid Taxes | If you owe unpaid taxes, federal or state agencies may garnish your wages, often without a court order. |

| Student Loans | Federal student loans that are not being paid can be garnished from wages without a court order from the government. |

| Struggling with any of the above wage garnishments and need a solution fast? Watch this quick YouTube video to learn How To End Your Wage Garnishment For Good. |

Legal process for medical debt garnishment

While various debts can lead to wage garnishment, medical debt follows a specific legal process:

Steps involved in garnishment for medical debt

If you fall behind on medical bills, creditors can eventually take legal steps to collect them. Wage garnishment is one of them, but it doesn’t start there. Here’s how the process usually comes out:

- A lawsuit

A hospital, clinic, or collection agency must file a lawsuit in civil court to recover what’s owed. They’ll need to show records of your bill, the amount due, and any previous attempts to collect. If you don’t respond to the court notice, the creditor usually wins by default.

- Judgment

If the court sides with the creditor, the creditor can issue a judgment that officially states you owe the money. This step is tough; it gives the creditor legal permission to move forward with collection. You’ll be notified, and depending on your state, you may still have time to contest it.

- Garnishment order

With a judgment in hand, the creditor can ask the court to send a garnishment order to your employer. This order tells them to take a set portion of your paycheck and send it directly to the creditor each pay period.

- Justification

Just because there’s an order doesn’t mean you’re out of options. In many states, you can request a hearing to justify your side; maybe the debt is wrong, or your income is legally protected. These hearings usually need to be requested quickly, sometimes within a week or two.

Exemptions and protections

Here are some exemptions under federal law:

How to prevent wage garnishment for medical debt?

Proactive steps can help you avoid wage garnishment for medical debt, saving you from financial strain and legal complications.

Here are steps you can take to prevent medical debt garnishment:

Payment plans and negotiations

Talk directly to your healthcare provider or debt collector to negotiate a payment plan and avoid wage garnishment. Here is how you can do it:

- Assess your financial situation before contacting your creditor. Determine the total amount you owe in debt and how much you can afford.

- Reach out to your creditor when it is difficult to make a payment. Be honest and explain your situation. Many creditors prefer to negotiate and find a solution.

- Suggest a way to solve the problem. Offer a solution based on your situation that works for both you and the creditor. For example, if you have saved up some money and you do not have the entire amount, offer to make one payment with what you have. You can also suggest a monthly payment plan according to how much you can afford.

- Make sure to keep records of everything you communicate with the creditor. Write down the dates and the details of any agreements and payment plans made. This can be really helpful if any issues may arise later.

Legal assistance and debt relief programs

The other option is to get legal help or choose a debt relief program:

- Talk to a debt relief lawyer for guidance and legal support.

- You can apply for a debt relief program through non-profit agencies that help with medical debt.

- A non-profit credit counseling agency assists you with your budgeting, repayment strategy, and negotiation with creditors on your behalf.

- A consumer proposal lets you offer to pay less than what you owe and can stop wage garnishment immediately. It involves extending an offer to creditors to settle out of court under the Bankruptcy and Insolvency Act.

- Bankruptcy as a last resort, If medical debt becomes unmanageable, bankruptcy may stop wage garnishment. Chapter 7 can erase most medical bills, while Chapter 13 lets you repay over time. It affects your credit, so speak with a bankruptcy attorney first.

Let Hall’s IRS be Your Guide to Save You from Wage Garnishment → Book an Appointment Now!

Federal and state wage garnishment laws

Certain federal and state provisions exist that shield one from wage garnishment.

Federal limits

A salary garnishment cannot exceed the figure permitted under the Consumer Credit Protection Act (CCPA). That is, an individual’s salary will be garnished only to a maximum of either 25% of disposable earnings or the amount by which disposable earnings exceed 30 times the federal minimum wage, whichever is less.

The federal minimum wage remains $7.25/hour in 2025, meaning garnishment cannot occur if your weekly disposable earnings are $217.50 or less.

Likewise, the Fair Debt Collection Practices Act (FDCPA) also protects an individual from debt collectors using abusive and deceptive strategies while attempting to collect the debt.

State rules

Laws protecting an individual from garnishment vary from state to state.

For example, in Arkansas, wage garnishment would apply according to federal rules, except for laborers and mechanics, who will have additional protections.

In California, the garnishment is the smaller of 25% of your disposable earnings or the amount that your earnings exceed 40 times the state’s minimum wage.

Conversely, Delaware allows 15% of disposable earnings to be garnished, compared to the federal maximum of 25%.

Consequences of ignoring medical debt

Ignoring medical debt won’t affect your financial health. Thus, it is important to know about the issues to address them in the appropriate avenues.

- Damaged credit scores: Ignoring medical debt lowers your credit score because healthcare providers can send the debt to collection agencies, who will then report it to credit bureaus as if a medical bill is unpaid by you. This makes it hard for you to acquire loans or rent a house.

- Increased interest rates: Your interest rates and late fees can increase the amount you owe if you do not pay your medical bills on time.

- Legal consequences: Creditors can take legal action if you don’t pay your medical debt. This may include a lawsuit or wage garnishment.

- Restricted access to future healthcare: Some providers may refuse future non-emergency care or send unpaid bills to collections if old debts remain unresolved.

Take control of your finances with Hall’s IRS

Medical debt collectors can garnish your wages only after a lawsuit and court order. And if managing debt feels stressful to you, a tax or legal expert can guide you through your options and protect your income. That’s where Hall’s IRS makes the difference.

We don’t just explain your rights; we help you fight for them. Our experts review your case in detail and personalize our service approach.

Wondering how else we can help?

- We contact collectors, challenge unfair claims, and negotiate on your behalf.

- If there’s a judgment against you, we’ll explore every legal option to reduce or dismiss it.

- If you’re behind on payments, we can create realistic repayment plans that protect your paycheck.

With Hall’s IRS, you get relief.

Let us help you keep what you’ve earned. Contact Hall’s IRS today to get the help you deserve.

FAQ's

No, medical debt collectors can not take money from your wages unless they’ve first gotten a court order. They need to file a lawsuit against you in court, win the case, and get a judgment before they can get an order for garnishment.

Under federal law, the amount that a medical debt can be taken from your wages does not exceed 25% of your disposable earnings or what your disposable earnings are above 30 times that of the federal minimum wage, whichever is smaller. If your weekly disposable income is $217.50 or less, they cannot garnish your wages.

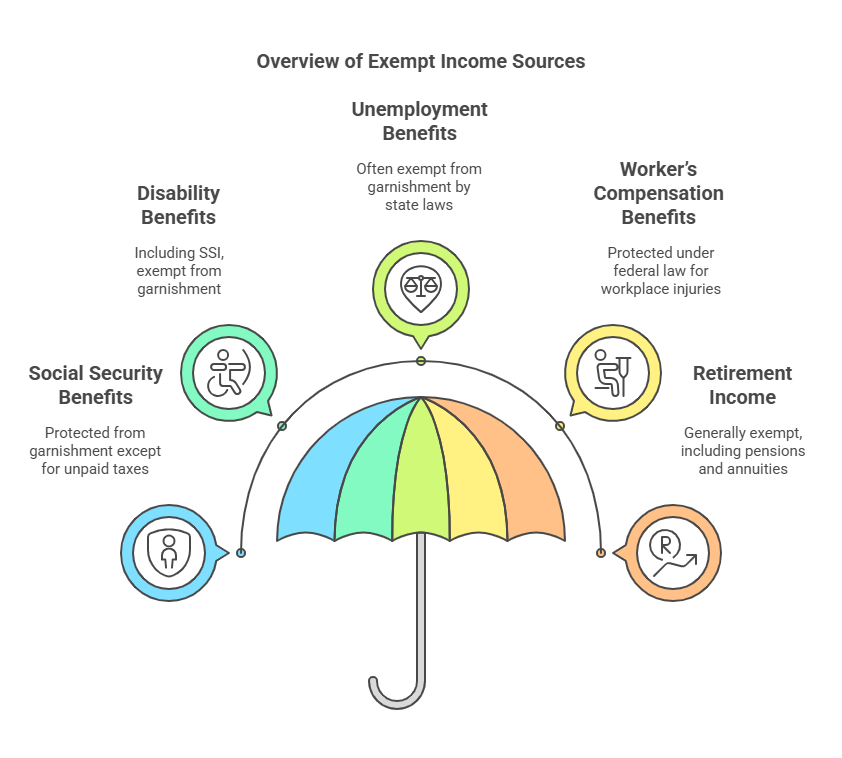

Some wages or income sources are protected against wage garnishment, such as Social Security benefits, disability benefits, Supplemental Security Income (SSI), unemployment income, workers’ compensation benefits, and retirement income or annuities.

Yes, you can negotiate with debt collectors regarding the medical debts you have to avoid garnishment. Many creditors prefer payment plans or settlements instead of taking legal action. You can contact them, explain your situation, and suggest a realistic repayment plan.

Federal laws protect workers who are facing wage garnishment. These laws include limits on how much wages can be garnished and exempt some incomes from garnishment. The Fair Debt Collection Practices Act (FDCPA) also stops debt collectors from being abusive or unfair.

2896 Comments. Leave new

http://estate.spb.ru/ajax/pages/nabor-pervoj-mediczinskoj-pomoshhi-vidy-sostav-i-naznachenie.html

igaming compaty

https://federalgaz.ru/

РФ оэрн официальный сайт РФ оэрн РФ обратная связь Россия обратная связь телефон

общество экспертов России по недропользованию

зарегистрироваться приобрести обратная связь телефон общество экспертов России по недропользованию сделать общество экспертов России по недропользованиюзарегистрироваться

iPhone ricondizionato Italia

азино сайт Азино – это имя, эхом разносящееся в виртуальных закоулках сети, словно далекий зов сирены. За манящим названием скрывается целый мир азартных развлечений, обещающий мгновенное обогащение и захватывающие эмоции. Однако, стоит помнить, что за каждым обещанием скрывается реальность, требующая осознанного подхода и здравого смысла.

melbet регистрации Melbet сайт – это удобная и функциональная платформа для ставок на спорт и игры в казино. Интуитивно понятный интерфейс, быстрая загрузка страниц и широкий выбор опций делают использование сайта максимально комфортным. На сайте Melbet можно найти все необходимое для успешной игры: статистику, результаты матчей, трансляции и многое другое.

azino Казино Азино – это отражение реальности, где шансы на выигрыш всегда ниже, чем шансы на проигрыш. Но именно этот риск придает игре остроту и азарт. Главное – играть ответственно, не ставя на кон последние деньги и не забывая о том, что в жизни есть гораздо больше важных и интересных вещей.

azino 777 Азино 777 вход – это ключевой момент для тех, кто желает испытать удачу в виртуальном казино. Процесс регистрации, как правило, прост и интуитивно понятен, однако важно помнить о мерах предосторожности и внимательно изучать правила платформы. Перед тем, как погрузиться в мир азартных игр, следует убедиться в надежности источника и осознавать риски, связанные с игрой на деньги.

pokerok скачать GGPokerok – это часть большой сети GGPoker, что обеспечивает огромный трафик игроков и щедрые призовые фонды в турнирах. Это дает возможность не только испытать себя в конкуренции с лучшими, но и заработать солидные деньги. GGPokerok – это место, где мечты становятся реальностью.

краби самостоятельно провинция краби таиланд

рейли краби погода краби тайланд декабрь

В статье-обзоре представлены данные сомнительной актуальности и факты без явной взаимосвязи. Читатель ознакомится с разными мнениями, хотя они вряд ли существенно изменят его представление о теме.

Подробнее читать – [url=https://rostov-narkologiya.ru/]детокс чай для похудения[/url]

https://vc.ru/migration/1335599-vse-vidy-vnzh-ispanii-kak-poluchit-spisok-dokumentov-i-trebovaniya-dlya-pereezda-na-pmzh-razberem-usloviya-i-osnovaniya-dlya-polucheniya-vida-na-zhitelstvo Наша команда экспертов всегда готова ответить на ваши вопросы и предоставить консультации по всем аспектам жизни и работы в Испании. Мы поможем вам разобраться в нюансах испанского законодательства, системы здравоохранения и образования. Мы предлагаем индивидуальные решения, учитывающие ваши личные обстоятельства и потребности.

запчасти на автомобили Lifan Удобная система поиска и заказа на нашем сайте позволяет быстро найти нужную деталь по артикулу, VIN-коду или названию. Наши квалифицированные консультанты всегда готовы помочь в выборе и предоставить профессиональную консультацию. Мы ценим ваше время и предлагаем оперативную доставку заказов по всей территории. Выбирая нас в качестве поставщика запчастей для вашего китайского автомобиля, вы получаете надежного партнера, ориентированного на долгосрочное сотрудничество и удовлетворение ваших потребностей.

здесь С нами процесс получения визы цифрового кочевника и адаптации в Испании станет простым и приятным. Забудьте о стрессе и неопределенности. Доверьтесь профессионалам, и вы сможете в полной мере насладиться всеми преимуществами жизни в этой прекрасной стране. Начните свой путь к новой жизни в Испании уже сегодня!

краби бейби игра бабал делать на красками краби видеообзор

сайт С нами процесс получения визы цифрового кочевника и адаптации в Испании станет простым и приятным. Забудьте о стрессе и неопределенности. Доверьтесь профессионалам, и вы сможете в полной мере насладиться всеми преимуществами жизни в этой прекрасной стране. Начните свой путь к новой жизни в Испании уже сегодня!

здесь С нами процесс получения визы цифрового кочевника и адаптации в Испании станет простым и приятным. Забудьте о стрессе и неопределенности. Доверьтесь профессионалам, и вы сможете в полной мере насладиться всеми преимуществами жизни в этой прекрасной стране. Начните свой путь к новой жизни в Испании уже сегодня!

электровелосипед шульц краби пляж ао нанг краби

запчасти Baw Помимо широкого ассортимента запчастей, мы предлагаем квалифицированную консультацию специалистов, готовых помочь в подборе необходимых деталей и предоставить техническую информацию. Мы понимаем, что правильный выбор запчасти – залог долговечной и безопасной эксплуатации автомобиля. Сотрудничая с нами, вы получаете не только качественную продукцию, но и надежного партнера, заинтересованного в вашем успехе. Выбирайте лучшее для своего китайского автомобиля!

самые красивые пляжи краби в тайланде аренда скутера краби

краби температура воды avani koh lanta krabi resort 4

открыть магазин с фиксированной ценой [url=https://oneprice.shop]https://oneprice.shop/[/url]

http://google.je/url?q=http://oneprice.shop

Статья содержит данные с сомнительной актуальностью и факты, лишённые чёткой взаимосвязи, но знакомит читателя с разными мнениями, пусть и без глубокого влияния.

Дополнительная информация – [url=https://stop-zavisimost.ru/]слоты на деньги[/url]

Недропользование — это направление деятельности, связанный с разработкой подземных богатств.

Оно включает добычу природных ресурсов и их промышленное освоение.

Данная сфера регулируется установленными правилами, направленными на охрану окружающей среды.

Эффективное управление в недропользовании способствует экономическому росту.

общество экспертов России по недропользованию

Базы пробитые Xrumer телеграм база xrumer

ко ланта ко ланта

Базы GSA сервера для xrumer телеграм

ко ланта ко ланте

Для жителей Красноярска организованы два конфиденциальных пути. Первый — немаркированный выезд бригады на дом с заранее согласованными порогами связи. Второй — «тихий вход» в клинику через отдельную дверь, где приём проходит без очередей и «коридорных» разговоров. На первичном звонке администратор уточняет только клинически значимые факторы: частоту рвоты, наличие мочеиспускания, ЧСС/АД в покое, эпизоды спутанности, актуальные лекарства и аллергии. Биографические подробности и лишние вопросы не задаются — мы придерживаемся принципа минимально необходимой информации.

Подробнее можно узнать тут – [url=https://narkologicheskaya-klinika-v-krasnoyarske17.ru/]www.domen.ru[/url]

УАЗ ПАТРИОТ АКПП УАЗ ПАТРИОТ с АКПП: Идеальное сочетание классической проходимости и современного комфорта. Автоматическая коробка передач превращает управление легендарным внедорожником в удовольствие, особенно в сложных городских условиях и на пересеченной местности. Этот автомобиль создан для тех, кто не боится трудностей и ценит свободу передвижения. УАЗ ПАТРИОТ АКПП обладает проверенной временем конструкцией, просторным салоном, вместительным багажником и мощным двигателем, готовым к любым испытаниям. Вы сможете с легкостью преодолевать бездорожье, чувствуя себя уверенно и комфортно за рулем. УАЗ ПАТРИОТ с АКПП – это ваш надежный партнер в любых приключениях, будь то поездка на рыбалку, охоту или путешествие по диким местам. Он готов к любым испытаниям и станет незаменимым помощником в вашей активной жизни.

прогнозы на футбол Бонусы букмекеров: используй максимум возможностей для увеличения своего выигрыша!

«Эгида Трезвости» выстраивает лечение вокруг предсказуемости: понятный старт, прозрачные шаги, нейтральная коммуникация и постоянная связь с дежурным врачом. Мы не заставляем объясняться «по кругу» и не перегружаем терминами — достаточно фактов, которые влияют на безопасность и выбор схемы. Уже при первом контакте становится ясно, где лучше начинать (дом, приём, стационар 24/7), что будет сделано в ближайшие часы и как оценим результат к вечеру. Конфиденциальность встроена в регламент: на звонках — нейтральные формулировки, на выездах — неброская экипировка, доступ к медицинской информации — только у задействованной команды. Это снижает фоновую тревогу и позволяет семье сосредоточиться на простых действиях, которые реально помогают держать курс.

Узнать больше – [url=https://narkologicheskaya-klinika-ehlektrostal0.ru/]narkologicheskaya-klinika-stacionar[/url]

оргонный_амулет Вихреваякатушка: Для создания вихревой энергии.

Сфера недропользования — это направление деятельности, связанный с разработкой подземных богатств.

Оно включает добычу полезных ископаемых и их рациональное использование.

Недропользование регулируется установленными правилами, направленными на охрану окружающей среды.

Эффективное управление в недропользовании обеспечивает устойчивое развитие.

общество экспертов России по недропользованию

Окна Rehau Алматы Выбор качественных пластиковых окон – это инвестиция в комфорт, тепло и энергоэффективность вашего дома. В Алматы, в условиях переменчивого климата, это особенно актуально. Компания Okna Service предлагает широкий ассортимент пластиковых окон, отвечающих самым высоким стандартам качества. Okna Service использует только проверенные профильные системы от ведущих производителей. Это гарантирует долговечность, устойчивость к перепадам температур и отличную звукоизоляцию. Вы можете выбрать окна с различной толщиной профиля, количеством камер и типами стеклопакетов, в зависимости от ваших индивидуальных потребностей и бюджета. Помимо качества продукции, Okna Service выделяется своим профессиональным подходом к установке. Квалифицированные монтажники с большим опытом работы гарантируют правильную установку окон, что является критически важным для обеспечения их функциональности и долговечности. Неправильный монтаж может свести на нет все преимущества даже самых дорогих окон. Okna Service предлагает полный спектр услуг, включая замер, изготовление, доставку и установку окон. Компания также предоставляет гарантийное и постгарантийное обслуживание. Вам помогут подобрать оптимальное решение для вашего дома или офиса, учитывая особенности архитектуры и ваши личные пожелания. Выбирая Okna Service, вы выбираете надежность, качество и профессионализм. Улучшите свой дом уже сегодня, установив новые пластиковые окна от Okna Service.

подвеска_оргонит_мужской Оберегдлядома: Хороший оберег для дома

Пластиковые окна в Алматы Выбор качественных пластиковых окон – это инвестиция в комфорт, тепло и энергоэффективность вашего дома. В Алматы, в условиях переменчивого климата, это особенно актуально. Компания Okna Service предлагает широкий ассортимент пластиковых окон, отвечающих самым высоким стандартам качества. Okna Service использует только проверенные профильные системы от ведущих производителей. Это гарантирует долговечность, устойчивость к перепадам температур и отличную звукоизоляцию. Вы можете выбрать окна с различной толщиной профиля, количеством камер и типами стеклопакетов, в зависимости от ваших индивидуальных потребностей и бюджета. Помимо качества продукции, Okna Service выделяется своим профессиональным подходом к установке. Квалифицированные монтажники с большим опытом работы гарантируют правильную установку окон, что является критически важным для обеспечения их функциональности и долговечности. Неправильный монтаж может свести на нет все преимущества даже самых дорогих окон. Okna Service предлагает полный спектр услуг, включая замер, изготовление, доставку и установку окон. Компания также предоставляет гарантийное и постгарантийное обслуживание. Вам помогут подобрать оптимальное решение для вашего дома или офиса, учитывая особенности архитектуры и ваши личные пожелания. Выбирая Okna Service, вы выбираете надежность, качество и профессионализм. Улучшите свой дом уже сегодня, установив новые пластиковые окна от Okna Service.

Капельница от запоя на дому в Нижнем Новгороде — быстрый и эффективный способ снять симптомы похмелья и восстановить организм. Наши специалисты приедут к вам домой и проведут процедуру с использованием современных препаратов.

Подробнее можно узнать тут – [url=https://snyatie-zapoya-na-domu16.ru/]помощь вывод из запоя нижний новгород[/url]

If you follow the Russian-language streaming scene, you’ve likely heard about the Mellstroy Game project. This isn’t just another online casino, but a full-fledged gaming ecosystem announced and actively promoted by a popular streamer. The website [url=https://jobhop.co.uk/blog/408770/———-480]mellstroy game[/url] offers a detailed look at the platform technical implementation, licensing, and current bonus terms. The core of the project is a synthesis of entertainment substance and classic speculation, where stream viewers can not only watch the gameplay but also participate directly through integrated mechanics.

An analysis of the game lobby reveals a serious approach to measure and classic speculation curation. The infrastructure partners with leading providers like NetEnt, Pragmatic Play, and Evolution Gaming, ensuring fair Return to Player (RTP) rates for slots and table games. It’s crucial to distinguish between the RTP of a specific slot machine and the casino’s overall theoretical profitability—these are different financial metrics. For example, slots like Book of Dead often feature an RTP around 96%, which is convention for quality products. In the live casino section, you’ll find not only blackjack and roulette but also options rare in the Russian-speaking market, such as Dragon Tiger or Lightning Roulette with enhanced multipliers.

Financial transactions are a critically important aspect for any aficionado. Mellstroy Game offers a dogma market set of payment systems: from VISA/Mastercard bank cards to e-wallets and cryptocurrencies. Pay close attention to the account verification policy. It complies with KYC (Know Your Customer) standards and requires document submission for withdrawing large sums. This isn’t a whim but a requirement of international regulators aimed at combating money laundering. Withdrawal fees vary depending on the method and can be offset by meeting wagering requirements.

The reward program requires detailed study. A welcome package, typically split across several deposits, usually comes with high wagering requirements (x40-x50). Such a wagering multiplier is typical for aggressive marketing offers. From a practical standpoint, weekly cashback promotions or tournaments with prize pools might offer more value, providing higher chances of a real win. Always read the full terms and conditions of promotions, especially clauses about maximum bet sizes while wagering a incentive and the list of eligible games.

The technical side is implemented on a responsive environment. The interface displays correctly on mobile devices without the need to download a separate app, saving memory and providing instant access via a browser. Modern SSL encryption is used to protect transaction data. To circumvent potential provider blocks, a working mirror site is provided; the current link can be found in the project’s official Telegram channel. This is measure practice for maintaining stable access.

Safety and responsible gaming are the foundation of trust. Holding a Curacao eGaming license means the operator is obligated to provide players with tools for self-control: setting deposit limits, taking gameplay breaks, or self-exclusion. Ignoring these tools is unwise. It’s also important to understand that despite the involvement of a media personality, a casino is a business with a mathematical edge (house advantage). Streams showcasing large wins are part of the marketing technique, not a guide to action.

The final conclusion on the Mellstroy Game project is nuanced. On one hand, it’s a professionally assembled platform with a license, a strong provider pool, and thoughtful logistics. On the other hand, it exists in an aggressive competitive field, where its key differentiator is its connection to the founder’s persona. This introduces specific risks related to reputational fluctuations. For an experienced contestant evaluating a casino through the lens of mathematics, technical reliability, and withdrawal conditions, the infrastructure presents certain interest. Beginners, however, should first study the basic principles of wagering, probability theory, and only then consider making a deposit, strictly based on their entertainment budget, not on expectations of quick profit.

Когда запой затягивается, организм быстро входит в режим перегрузки: нарушается сон, скачет давление, усиливается тревога, появляется дрожь, тошнота, потливость и резкая слабость. В такой ситуации «перетерпеть» или лечиться домашними средствами — рискованная стратегия: состояние может ухудшаться волнами, а осложнения иногда развиваются резко, без долгой подготовки. Выезд нарколога на дом в Красногорске нужен для того, чтобы снять острую интоксикацию и абстиненцию безопасно, под контролем показателей, без лишней суеты и без поездок по стационарам в разгар плохого самочувствия.

Исследовать вопрос подробнее – https://narkolog-na-dom-krasnogorsk6.ru/narkolog-i-psikhiatr-krasnogorsk/

подвеска_семечко Оберегмагический: магический оберег

серіали 2025 дивитись онлайн найкращі фільми за рейтингом глядачів

Что включено на практике

Подробнее тут – http://narkologicheskaya-klinika-shchyolkovo0.ru

Мир онлайн-слотов растёт: новые провайдеры, повышенные RTP и постоянные турниры поддерживают интерес игроков.

Vavada удерживает позиции в топе, но не забывайте проверять лицензию и лимиты перед депозитом.

Выбирайте автоматы с бонусными раундами, бесплатными вращениями и прогрессивными джекпотами — так повышается шанс крупного выигрыша.

Зеркала решают проблему блокировок и позволяют оперативно выводить средства без лишних задержек.

Актуальные возможности доступны здесь: http://global-climate-change.ru/media/pgs/v_kakom_kazino_daut_realnue_dengi_za_registraciu__9.html.

Играйте ответственно и контролируйте банкролл, чтобы азарт оставался в пределах удовольствия.

Этот информационный набор привлекает внимание множеством мелочей и странных ракурсов. Мы предлагаем взгляды, которые редко бывают полезны, но могут слегка разнообразить ваше знакомство с темой.

Вот – [url=https://arma-rehab.ru/vyvod-iz-zapoya/]порно смотреть[/url]

Капельница формируется индивидуально и включает растворы для регидратации, препараты для защиты печени, витаминизацию и седативные средства. Врач следит за реакцией организма, корректирует дозировку и контролирует показатели.

Ознакомиться с деталями – [url=https://vyvod-iz-zapoya-v-himki1.ru/]вывод из запоя на дому срочно[/url]

В статье-обзоре представлены данные сомнительной актуальности и факты без явной взаимосвязи. Читатель ознакомится с разными мнениями, хотя они вряд ли существенно изменят его представление о теме.

Подробнее читать – [url=https://rostov-narkologiya.ru/]народные средства от диабета[/url]

Interesting! Did you know that in [url=https://mekhov.com/][color=#1C1C1C]Turkey you can find a dream fur coat for half the price of a European one? Just a fact.[/color][/url]

Этот сборник информации привлекает множеством мелких деталей и необычных ракурсов. Мы предлагаем взгляды, редко полезные, но способные немного разнообразить знакомство с темой.

Подробнее читать – [url=https://rostov-narkologiya.ru/uslugi-ot-narkomanii/mefedronovaya-zavisimost/]народные средства от диабета[/url]

:::::::::::::::: ONLY THE BEST ::::::::::::::::

Content from TOR websites Magic Kingdom, TLZ,

Childs Play, Baby Heart, Giftbox, Hoarders Hell,

OPVA, Pedo Playground, GirlsHUB, Lolita City

More 3000 videos and 20000 photos girls and boys

h**p://tiny.cc/sficzx

h**p://j1d.ca/_J

h**p://put2.me/muhcsh

Complete series LS, BD, YWM, Liluplanet

Sibirian Mouse, St. Peterburg, Moscow

Kids Box, Fattman, Falkovideo, Bibigon

Paradise Birds, GoldbergVideo, BabyJ

h**p://citly.me/47kMX

h**p://4ty.me/ibhi7c

h**p://tt.vg/URoSx

Cat Goddess, Deadpixel, PZ-magazine

Tropical Cuties, Home Made Model (HMM)

Fantasia Models, Valya and Irisa, Syrup

Buratino, Red Lagoon Studio, Studio13

—————–

—————–

000A000463

[url=https://rhsolutions1.in]Купить пластиковые окна на заказ в Москве[/url] — это отличный способ улучшить энергоэффективность вашего дома и повысить его комфорт.

Одним из ключевых преимуществ пластиковых окон является их долгий срок службы.

Нужны цветы где купить розы на пхукете мы предлагаем свежие и невероятно красивые букеты, которые порадуют любого получателя. Наша служба обеспечивает оперативную доставку по всему острову, а в ассортименте вы найдёте цветы и композиции на самый взыскательный вкус. При этом мы гордимся тем, что сохраняем лучшие цены на острове — красота теперь доступна без переплат!

Нужен детейлинг детейлинг мойка кипр специализированный детейлинг центр на Кипре в Лимассоле, где заботятся о безупречном состоянии автомобилей, предлагая клиентам полный комплекс услуг по уходу за транспортными средствами. Мастера студии с вниманием относятся к каждой детали: они не только выполняют оклейку кузова защитными материалами, но и проводят тщательную обработку салона, возвращая автомобилю первозданный вид.

Делаешь документы? генератор документов позволяет существенно ускорить работу: с его помощью вы сможете готовить необходимые документы в десять раз быстрее и при этом гарантированно избегать ошибок. Инструмент предельно прост в освоении — специальное обучение не требуется. Все ваши данные надёжно защищены, а настройка индивидуальных шаблонов выполняется оперативно и без сложностей.

Do you want bonuses? CSGOFAST Bonus Code deposit bonuses, free cases, terms and conditions. A quick activation guide, FAQ, and the latest updates.

Продвижение сайтов https://team-black-top.ru под ключ: аудит, стратегия, семантика, техоптимизация, контент и ссылки. Улучшаем позиции в Google/Яндекс, увеличиваем трафик и заявки. Прозрачная отчетность, понятные KPI и работа на результат — от старта до стабильного роста.

Rebricek najlepsich kasin https://betrating.sk/casino-hry/automaty-online/def-leppard-hysteria/ na Slovensku: bezpecni prevadzkovatelia, lukrativne bonusy, hracie automaty a zive kasina, pohodlne platby a zakaznicka podpora. Cestne recenzie a aktualizovane zoznamy pre pohodlne online hranie.

Najlepsie online kasina betrating.sk na Slovensku – porovnajte licencie, bonusy, RTP, vyplaty a mobilne verzie. Pomozeme vam vybrat spolahlive kasino pre hru o skutocne peniaze a demo. Pravidelne aktualizujeme nase hodnotenia a propagacne akcie.

SEO-продвижение сайта https://seo-topteam.ru в Москве с запуском от 1 дня. Экспресс-анализ, приоритетные правки, оптимизация под ключевые запросы и регион. Работаем на рост позиций, трафика и лидов. Подходит для бизнеса и услуг.

Анонимность и конфиденциальность гарантированы в клинике «Частный Медик 24». Мы обеспечиваем полную анонимность и конфиденциальность на всех этапах лечения.

Ознакомиться с деталями – http://kapelnica-ot-zapoya-podolsk13.ru/http://kapelnica-ot-zapoya-podolsk13.ru

Тяговые аккумуляторные https://ab-resurs.ru батареи для складской техники: погрузчики, ричтраки, электротележки, штабелеры. Новые АКБ с гарантией, помощь в подборе, совместимость с популярными моделями, доставка и сервисное сопровождение.

Продажа тяговых АКБ https://faamru.com для складской техники любого типа: вилочные погрузчики, ричтраки, электрические тележки и штабелеры. Качественные аккумуляторные батареи, долгий срок службы, гарантия и профессиональный подбор.

Тяговые аккумуляторные https://ab-resurs.ru батареи для складской техники: погрузчики, ричтраки, электротележки, штабелеры. Новые АКБ с гарантией, помощь в подборе, совместимость с популярными моделями, доставка и сервисное сопровождение.

Продажа тяговых АКБ https://faamru.com для складской техники любого типа: вилочные погрузчики, ричтраки, электрические тележки и штабелеры. Качественные аккумуляторные батареи, долгий срок службы, гарантия и профессиональный подбор.

новинки кіно онлайн турецькі серіали українською мовою

дивитися фільми підбірка фільмів на вихідні

Онлайн курсы психологии https://ilmacademy.com.ua удобный формат обучения для тех, кто хочет освоить профессию психолога, получить практические навыки и пройти профессиональное обучение дистанционно. Курсы подойдут для начинающих и специалистов, ориентированных на практику.

Нужна тара? https://mkr-big-bag.ru Компания “МКР-Биг-Бэг” — производство и продажа биг-бэгов (МКР) оптом. Широкий ассортимент мягких контейнеров для сыпучих материалов. Индивидуальные заказы, доставка по России. Надежно, быстро, выгодно!

Белое SEO https://seomgroup.ru работает. Спустя год работ с уверенностью это говорю. Главное найти спецов, которые не обещают золотые горы за месяц. Нормальные результаты, это минимум 3-4 месяца работы. Зато теперь получаем стабильный органический трафик, не как с рекламы, где бюджет кончился и все.

Комиссионный центр https://skypka.tv специализируется на скупке самой разной техники — от смартфонов и телевизоров до фотоаппаратов и игровой электроники, так что выгодно избавиться можно практически от любых лишних устройств.

Свежие новости https://arguments.kyiv.ua Украины и мира: события в Киеве и регионах, экономика, общество, происшествия, спорт, технологии и культура. Оперативная лента 24/7, аналитика, комментарии, фото и видео.

Новостной портал https://dailynews.kyiv.ua Украины с проверкой фактов: важные заявления, решения властей, бизнес и финансы, жизнь городов и областей, погода, транспорт, культура. Удобные рубрики и поиск, обновления каждый час, коротко и по делу.

Женский портал https://elegantwoman.kyiv.ua о красоте, здоровье и стиле жизни: уход за кожей и волосами, мода, отношения, психология, карьера, дом и вдохновение. Полезные советы, подборки, рецепты и лайфхаки на каждый день. Читайте онлайн с телефона и компьютера.

Главные новости https://novosti24.kyiv.ua Украины сегодня — быстро и понятно. Репортажи из регионов, интервью, разборы, инфографика, фото/видео. Следите за темами, сохраняйте материалы и делитесь. Лента обновляется 24/7, чтобы вы были в курсе событий.

Всё для женщин https://glamour.kyiv.ua в одном месте: тренды моды и бьюти, здоровье, питание, спорт, семья, дети, отношения и саморазвитие. Статьи, чек-листы, идеи и обзоры, которые помогают принимать решения и чувствовать себя увереннее.

Эта статья сочетает познавательный и занимательный контент, что делает ее идеальной для любителей глубоких исследований. Мы рассмотрим увлекательные аспекты различных тем и предоставим вам новые знания, которые могут оказаться полезными в будущем.

Проверенные методы — узнай сейчас – https://www.realty-key.ru/themes/stroitelstvo

Ежедневные новости https://useti.org.ua Украины: политика и экономика, общество и медицина, образование, технологии, спорт и шоу-бизнес. Мы собираем информацию из надежных источников и объясняем контекст. Читайте онлайн с телефона и компьютера — удобно и бесплатно.

Все о событиях https://ua-vestnik.com в Украине и вокруг: оперативные сводки, расследования, мнения экспертов, рынки и курс валют, происшествия и полезные сервисы. Подборки по темам, теги, уведомления, фото и видео — актуально в любое время.

Портал для женщин https://woman24.kyiv.ua про жизнь без лишнего: красота, женское здоровье, питание, рецепты, уютный дом, финансы, работа и отдых. Практичные советы, честные обзоры и вдохновляющие истории.

Женский онлайн-журнал https://womanlife.kyiv.ua бьюти-гайды, мода, психология, отношения, материнство и забота о себе. Подборки товаров, инструкции, рецепты и идеи для дома. Читайте коротко или глубоко — удобная навигация и свежие материалы каждый день.

Медицинский портал https://medicalanswers.com.ua для пациентов: здоровье, диагностика, лечение, профилактика и образ жизни. Экспертные статьи, справочник симптомов, советы специалистов и актуальные медицинские новости. Достоверная информация в одном месте.

Новости Украины https://news24.in.ua 24/7: Киев и регионы, экономика, общество, безопасность, технологии, спорт и культура. Короткие сводки, подробные материалы, объяснения контекста, фото и видео. Читайте главное за день и следите за обновлениями в удобной ленте.

Современный женский https://storinka.com.ua портал: уход, макияж, тренировки, питание, стиль, любовь, семья и карьера. Экспертные советы, полезные подборки, идеи подарков и лайфхаки. Мы говорим простым языком о важном — заходите за вдохновением ежедневно.

Новостной портал https://ua-novosti.info Украины без лишнего: оперативная лента, репортажи из областей, интервью и разборы. Политика, финансы, социальные темы, медицина, образование, IT. Фото/видео, инфографика, уведомления и топ-материалы дня.

Актуальные новости https://uapress.kyiv.ua Украины и мира: события, заявления, решения, рынки, курсы, происшествия и жизнь регионов. Факты и проверенные источники, аналитика и комментарии. Удобные рубрики, поиск, теги и подборки — всё, чтобы быстро находить нужное.

Клиника обеспечивает анонимность и безопасность. Информация о пациентах не передаётся третьим лицам, а процедуры выполняются в комфортных условиях с использованием сертифицированных препаратов и современного оборудования.

Подробнее тут – https://narkologicheskaya-klinika-v-novokuzneczke17.ru/narkologiya-gorod-novokuzneczk

Главные события https://vesti.in.ua Украины — коротко и понятно. Мы собираем новости из Украины и мира, проверяем данные и даём ясные объяснения. Подборки по темам, новости городов, аналитика, мнения, видео. Обновления каждый час, удобно на смартфоне.

Всё о здоровье https://medfactor.com.ua на одном медицинском портале: болезни и их лечение, анализы, препараты, обследования и профилактика. Материалы подготовлены с опорой на клинические данные и врачебную практику. Читайте онлайн в любое время.

Онлайн-журнал https://love.zt.ua для женщин: мода, бьюти, психология, любовь, семья, дети, дом, карьера и финансы. Обзоры, лайфхаки, рецепты и инструкции — без «воды», с пользой. Удобные рубрики и свежие материалы ежедневно.

Электронные компоненты https://zener.ru с прямыми поставками от производителей: микросхемы, пассивные элементы, разъёмы и модули. Гарантия оригинальности, стабильные сроки, выгодные цены и подбор под ТЗ. Поставки для производства, сервиса и разработки.

Нужен дизайн? дизайн студии спб создаем функциональные и стильные пространства для квартир, домов и офисов. Планировки, 3D-визуализации, подбор материалов и авторский надзор. Индивидуальный подход, реальные сроки и продуманные решения под ваш бюджет.

Решил сделать ремонт? дизайн интерьера стоимость спб: квартиры, дома, апартаменты и офисы. Продуманные планировки, 3D-проекты, сопровождение ремонта и контроль реализации. Создаем интерьеры, отражающие ваш стиль и образ жизни.

Checked out vipdubaiagency.com while browsing Dubai companions platforms. The site has a sleek design, a wide selection of services, straightforward pricing, and a smooth booking process. It feels more top-tier than most agencies I’ve encountered. Definitely recommended checking if you are looking for full services in whole platform.

Visit: https://vipdubaiagency.com/

Женский портал https://replyua.net.ua про красоту и заботу о себе: уход, макияж, волосы, здоровье, питание, спорт, стиль и отношения. Практичные советы, чек-листы, подборки и вдохновляющие истории. Читайте онлайн и находите идеи на каждый день.

Онлайн-портал https://avian.org.ua для строительства и ремонта: от фундамента до отделки. Подбор материалов, пошаговые гайды, сравнение технологий, советы мастеров и актуальные цены. Полезно для застройщиков, подрядчиков и частных клиентов.

Строительный портал https://ateku.org.ua о ремонте и строительстве: технологии, материалы, сметы, проекты домов и квартир, инструкции и советы экспертов. Обзоры, калькуляторы, нормы и примеры работ — всё для частного и коммерческого строительства.

online access – Pages respond quickly, simple design, very user-friendly

directionpowersmovement site – Crisp design, easy-to-read content, and browsing feels seamless

В этой информационной статье вы найдете интересное содержание, которое поможет вам расширить свои знания. Мы предлагаем увлекательный подход и уникальные взгляды на обсуждаемые темы, побуждая пользователей к активному мышлению и критическому анализу.

Открыть полностью – https://unarcencielpourclara.org/parrainage

digital shopping hub – Clean, modern layout aligns with today’s retail expectations.

Эта разъяснительная статья содержит простые и доступные разъяснения по актуальным вопросам. Мы стремимся сделать информацию понятной для широкой аудитории, чтобы каждый мог разобраться в предмете и извлечь из него максимум пользы.

Нажмите, чтобы узнать больше – https://freshwater.tecnovaters.com/tag/bugatti

Эта статья предлагает живое освещение актуальной темы с множеством интересных фактов. Мы рассмотрим ключевые моменты, которые делают данную тему важной и актуальной. Подготовьтесь к насыщенному путешествию по неизвестным аспектам и узнайте больше о значимых событиях.

Не пропусти важное – https://meghnasfoodmagic.in/recipe/veg-gold-coin

Этот информативный текст отличается привлекательным содержанием и актуальными данными. Мы предлагаем читателям взглянуть на привычные вещи под новым углом, предоставляя интересный и доступный материал. Получите удовольствие от чтения и расширьте кругозор!

Кликни и узнай всё! – https://epoxiparapisos.com/3d-epoxy

В этом информативном тексте представлены захватывающие события и факты, которые заставят вас задуматься. Мы обращаем внимание на важные моменты, которые часто остаются незамеченными, и предлагаем новые перспективы на привычные вещи. Подготовьтесь к тому, чтобы быть поглощенным увлекательными рассказами!

Перейти к статье – https://banfftravelers.com/pack-smart-essential-clothing-tips-for-your-banff-trip

Публикация предлагает читателю не просто информацию, а инструменты для анализа и саморазвития. Мы стимулируем критическое мышление, предлагая различные точки зрения и призывая к самостоятельному поиску решений.

Что ещё нужно знать? – https://timestotravel.com/how-to-make-the-most-of-a-business-trip-a-comprehensive-guide-for-indian-professionals

Этот текст призван помочь читателю расширить кругозор и получить практические знания. Мы используем простой язык, наглядные примеры и структурированное изложение, чтобы сделать обучение максимально эффективным и увлекательным.

Разобраться лучше – https://risenshinedriving.com/index.php/2021/03/13/michelle-got-her-driving-licence

В статье представлены ключевые моменты по актуальной теме, дополненные советами экспертов и ссылками на дополнительные ресурсы. Цель материала — дать читателю инструменты для самостоятельного развития и принятия осознанных решений.

Что скрывают от вас? – http://www.marvelcompany.co.jp/marvelous/r-0

Эта статья для ознакомления предлагает читателям общее представление об актуальной теме. Мы стремимся представить ключевые факты и идеи, которые помогут читателям получить представление о предмете и решить, стоит ли углубляться в изучение.

Где почитать поподробнее? – https://dainikpahad.com/archives/3061

storefront – Browsing from mobile worked flawlessly, and the category structure is neat.

tekvo source – Clean pages, clear content, and user experience is effortless

EasyClickPlavex – Smooth pages, organized layout, and content easy to browse.

В этой статье собраны факты, которые освещают целый ряд важных вопросов. Мы стремимся предложить читателям четкую, достоверную информацию, которая поможет сформировать собственное мнение и лучше понять сложные аспекты рассматриваемой темы.

Погрузиться в научную дискуссию – https://www.bharatsokagakkai.org/151-273×235

В этой статье-обзоре мы соберем актуальную информацию и интересные факты, которые освещают важные темы. Читатели смогут ознакомиться с различными мнениями и подходами, что позволит им расширить кругозор и глубже понять обсуждаемые вопросы.

А есть ли продолжение? – https://mazojiitalija.lt/produktas/aka-salento-igt-rosato

Эта обзорная заметка содержит ключевые моменты и факты по актуальным вопросам. Она поможет читателям быстро ориентироваться в теме и узнать о самых важных аспектах сегодня. Получите краткий курс по современной информации и оставайтесь в курсе событий!

Тыкай сюда — узнаешь много интересного – https://heavenlynews.org/could-irans-use-of-drones-and-missiles-against-israel-on-april-14-2024-be-a-strong-indication-that-the-second-coming-of-jesus-and-the-end-of-the-world-are-drawing-near

Строительный портал https://domtut.com.ua с практикой: проекты, чертежи, СНиП и ГОСТ, инструменты, ошибки и решения. Ремонт квартир, строительство домов, инженерные системы и благоустройство. Понятно, по делу и с примерами.

Украинские новости https://polonina.com.ua онлайн: всё важное о стране, регионах и мире — от экономики и инфраструктуры до культуры и спорта. Лента 24/7, материалы редакции, комментарии экспертов, фото и видео. Читайте, сохраняйте и делитесь — быстро и удобно.

В этой статье собраны факты, которые освещают целый ряд важных вопросов. Мы стремимся предложить читателям четкую, достоверную информацию, которая поможет сформировать собственное мнение и лучше понять сложные аспекты рассматриваемой темы.

Узнайте всю правду – https://www.powertvnews.in/2025/06/07/i-have-not-spoken-about-shivanna-darshan-and-dhruv-manu-clarifies-while-coming-out-of-jail

Всё о строительстве https://hydromech.kiev.ua и ремонте в одном месте: материалы, технологии, дизайн, инженерия и безопасность. Экспертные статьи, инструкции, калькуляторы и кейсы. Помогаем планировать работы и экономить бюджет без потери качества.

В этой статье представлен занимательный и актуальный контент, который заставит вас задуматься. Мы обсуждаем насущные вопросы и проблемы, а также освещаем истории, которые вдохновляют на действия и изменения. Узнайте, что стоит за событиями нашего времени!

Изучить материалы по теме – https://www.nextstopin.com/tex-mex-restaurants-in-san-antonio

Эта познавательная публикация погружает вас в море интересного контента, который быстро захватит ваше внимание. Мы рассмотрим важные аспекты темы и предоставим вам уникальные Insights и полезные сведения для дальнейшего изучения.

Продолжить изучение – https://psychiatriegespraech.ch/psychische-stoerungen-und-erkrankungen/persoenlichkeitsstoerungen_aetiologie

В статье представлены ключевые моменты по актуальной теме, дополненные советами экспертов и ссылками на дополнительные ресурсы. Цель материала — дать читателю инструменты для самостоятельного развития и принятия осознанных решений.

Полная информация здесь – https://www.statewideinspection.com/carpet-dye-spot-dyeing

Эта статья сочетает в себе как полезные, так и интересные сведения, которые обогатят ваше понимание насущных тем. Мы предлагаем практические советы и рекомендации, которые легко внедрить в повседневную жизнь. Узнайте, как улучшить свои навыки и обогатить свой опыт с помощью простых, но эффективных решений.

Открыть полностью – https://kkarenism.com/nohello

sonabet.pro

Эта статья для ознакомления предлагает читателям общее представление об актуальной теме. Мы стремимся представить ключевые факты и идеи, которые помогут читателям получить представление о предмете и решить, стоит ли углубляться в изучение.

Читать далее > – https://www.adinkraradio.com/essay-writing-service-rent-high-writers-online-3

Эта статья сочетает познавательный и занимательный контент, что делает ее идеальной для любителей глубоких исследований. Мы рассмотрим увлекательные аспекты различных тем и предоставим вам новые знания, которые могут оказаться полезными в будущем.

А что дальше? – https://pizza-gloria.be/2019/09/03/5-great-tips-for-finding-color-inspiration

Ищете вакансии в Израиле? Откройте сайт 4israel.co.il/ru/jobs/ и вы увидите огромное число предложений. Просто выбирайте округ Израиля и город, а сайт покажет вам все выгодные предложения о работе. Занятость в Израиле это огромное число безвозмездных вакансий – вы непременно выберете для себя место или выкладывайте свои позиции и получайте реакции кандидатов. Наш ресурс наиболее комфортный для подбора работы и персонала. Более полная информация на ресурсе.

Xelarionix World Shop – Layout intuitive, pages responsive and buying process effortless.

portal hub – Stumbled onto it, navigation is smooth and design is friendly.

Эта статья сочетает познавательный и занимательный контент, что делает ее идеальной для любителей глубоких исследований. Мы рассмотрим увлекательные аспекты различных тем и предоставим вам новые знания, которые могут оказаться полезными в будущем.

Есть чему поучиться – https://patanjaliayurved.org/product/detergent-powder-premium

Learn From Experts – The material is insightful and gives me ideas I hadn’t considered.

Xelra Flow – Interface simple, pages responsive and checkout steps clear and quick.

Портал для строителей https://inter-biz.com.ua и заказчиков: советы по ремонту, обзоры материалов, расчёты, сметы и технологии. Реальные кейсы, чек-листы и рекомендации специалистов для надежного результата на каждом этапе работ.

Строительный портал https://prezent-house.com.ua строительство домов и зданий, ремонт квартир, инженерные системы и отделка. Пошаговые инструкции, обзоры материалов, расчёты и советы экспертов для частных и коммерческих проектов.

Женский журнал https://asprofrutsc.org онлайн: тренды бьюти и моды, лайфхаки для дома, рецепты, материнство, карьера и финансы. Экспертные материалы, понятные инструкции и идеи, которые можно применить сразу. Обновления ежедневно, удобная навигация.

Visit Zaviro – Site responds fast, layout clear, and shopping steps feel simple and reliable.

Не можете добраться до клиники? Нарколог на дом в Иркутске – оптимальный выход при запое. Нарколог на дом – это удобно: обследование, лечение и детоксикация в комфортных условиях. Выезд нарколога в любое время, анонимность и безопасность – это «ТрезвоМед». Без медицинской помощи не обойтись? Звоните наркологу! Чем быстрее помощь, тем лучше прогноз, – нарколог Игорь Васильев.

Получить дополнительные сведения – [url=https://narcolog-na-dom-v-irkutske0.ru/narkolog-na-dom-czena-irkutsk/]narcolog-na-dom-v-irkutske0.ru/narkolog-na-dom-czena-irkutsk/[/url]

quick link – Minimal distractions, everything feels clear and easy to access

online marketplace hub – Modern interface emphasizes speed and convenience for today’s users.

В этой статье представлен занимательный и актуальный контент, который заставит вас задуматься. Мы обсуждаем насущные вопросы и проблемы, а также освещаем истории, которые вдохновляют на действия и изменения. Узнайте, что стоит за событиями нашего времени!

Смотрите также – https://www.kslegionovia.pl/2-zespol/lo-legionovia-ii-legionowo-50-grom-lipowo/attachment/img_1076

actionpowersmovement page – Straightforward design, headings are clear, and browsing is effortless

storefront – The support reply was friendly and well-worded.

выпрямитель дайсон airstrait купить [url=https://vypryamitel-dsn-kupit-4.ru/]выпрямитель дайсон airstrait купить[/url] .

Портал для строителей https://inter-biz.com.ua и заказчиков: советы по ремонту, обзоры материалов, расчёты, сметы и технологии. Реальные кейсы, чек-листы и рекомендации специалистов для надежного результата на каждом этапе работ.

Женский журнал https://asprofrutsc.org онлайн: тренды бьюти и моды, лайфхаки для дома, рецепты, материнство, карьера и финансы. Экспертные материалы, понятные инструкции и идеи, которые можно применить сразу. Обновления ежедневно, удобная навигация.

Строительный портал https://prezent-house.com.ua строительство домов и зданий, ремонт квартир, инженерные системы и отделка. Пошаговые инструкции, обзоры материалов, расчёты и советы экспертов для частных и коммерческих проектов.

seo кейсы [url=https://seo-kejsy7.ru/]seo кейсы[/url] .

онлайн школа для детей [url=https://shkola-onlajn13.ru/]онлайн школа для детей[/url] .

axory corner – Minimalist design, intuitive navigation, and fast-loading pages

После первичной диагностики начинается активная фаза медикаментозного вмешательства. Современные препараты вводятся капельничным методом, что позволяет оперативно снизить уровень токсинов в крови, восстановить нормальный обмен веществ и нормализовать работу внутренних органов, таких как печень, почки и сердце. Этот этап критически важен для стабилизации состояния пациента и предотвращения дальнейших осложнений.

Выяснить больше – https://vyvod-iz-zapoya-tula00.ru

olvra homepage – Quick load times with a well-structured layout and trustworthy content

Вывод из запоя в клинике проводится поэтапно, что позволяет обеспечить прозрачность процесса и полное понимание динамики выздоровления.

Получить дополнительную информацию – [url=https://vyvod-iz-zapoya-omsk0.ru/]вывод из запоя капельница[/url]

Многие сталкиваются с трудностями при выборе клиники или центра: предлагаемые услуги различаются по качеству, подходам, стоимости и длительности. Некоторые организации ограничиваются только медикаментозной поддержкой, не работая с глубинными причинами зависимости. Поэтому важно заранее понимать, какие параметры отличают действительно надёжное учреждение, способное обеспечить долгосрочные результаты.

Ознакомиться с деталями – https://lechenie-narkomanii-murmansk0.ru/lechenie-narkomanii-i-alkogolizma-marmansk/

Даже телефонный разговор с клиникой может многое сказать о её подходе. Если вам предлагают типовое лечение без уточнения подробностей или избегают вопросов о составе команды, это тревожный сигнал. Серьёзные учреждения в Мурманске обязательно предложат предварительную консультацию, зададут уточняющие вопросы и расскажут, как строится программа помощи.

Углубиться в тему – [url=https://lechenie-alkogolizma-murmansk0.ru/]центр лечения алкоголизма мурманская область[/url]

Go to web sait https://cryptomonitor.info/ where you will find a free web application for tracking, screening and technical analysis of the cryptocurrency market. Cryptomonitor is the best tools for crypto traders that allow you to receive comprehensive information. The site also presents all the latest news from the world of cryptocurrencies.

Rixaro Direct Shop – Site responsive, content straightforward and buying process simple.

zorivoshop link – Fast, clean, and easy to browse without distractions.

Портал для женщин https://angela.org.ua о современном лайфстайле: бьюти-рутины, мода, здоровье, правильное питание, отношения, работа и отдых. Полезные подборки, честные обзоры, истории и советы экспертов — заходите за вдохновением 24/7.

Портал для женщин https://beautyrecipes.kyiv.ua про гармонию и результат: здоровье, красота, стиль, саморазвитие, семья и отношения. Обзоры косметики и процедур, планы питания, тренировки, советы по дому и вдохновляющие истории. Всё в одном месте, 24/7.

MorixoNavigator – Clean layout, pages load quickly, and finding items feels natural.

Ниже — ориентир для острых часов на дому. Это не жёсткий шаблон, а карта, где ясно: что делаем, чем измеряем, когда пересматриваем. При отсутствии отклика мы меняем один параметр (например, темп инфузии) и назначаем новое окно оценки, не «двигая» всё остальное.

Изучить вопрос глубже – [url=https://narkolog-na-dom-saratov0.ru/]вызвать нарколога на дом[/url]

Всё, что важно https://inclub.lg.ua женщине: здоровье и гормоны, питание и фитнес, стиль и гардероб, отношения и самооценка, уют и рецепты. Экспертные статьи, тесты и подборки. Сохраняйте любимое и делитесь — удобно на телефоне.

International Networking Hub – Designed in a way that supports smooth global engagement.

Не можете добраться до клиники? Нарколог на дом в Иркутске – оптимальный выход при запое. Нарколог на дом – это удобно: обследование, лечение и детоксикация в комфортных условиях. Выезд нарколога в любое время, анонимность и безопасность – это «ТрезвоМед». Без медицинской помощи не обойтись? Звоните наркологу! Чем быстрее помощь, тем лучше прогноз, – нарколог Игорь Васильев.

Узнать больше – [url=https://narcolog-na-dom-v-irkutske0.ru/]вызов нарколога цена в иркутске[/url]

Kryvox Market – Fast loading, interface neat and browsing through products was simple.

Зависимость от психоактивных веществ — серьёзное заболевание, затрагивающее как физическое, так и психологическое состояние человека. При отсутствии своевременной наркологической помощи в клинике возможно ухудшение здоровья, развитие тяжелых осложнений и социальная деградация пациента.

Разобраться лучше – [url=https://narkologicheskaya-pomoshh-novokuzneczk0.ru/]нарколог наркологическая помощь[/url]

Прежде чем принимать решение, важно изучить сайт клиники. В надёжных учреждениях размещена полная информация о врачах, их образовании и опыте работы. Кроме того, пациентам предлагается пройти предварительную консультацию — чаще всего она проводится анонимно и включает первичную диагностику. Это позволяет оценить профессионализм команды ещё до начала терапии.

Подробнее тут – http://narkologicheskaya-klinika-yaroslavl0.ru/chastnaya-narkologicheskaya-klinika-yaroslavl/

Портал для женщин https://angela.org.ua о современном лайфстайле: бьюти-рутины, мода, здоровье, правильное питание, отношения, работа и отдых. Полезные подборки, честные обзоры, истории и советы экспертов — заходите за вдохновением 24/7.

Использование автоматизированных систем дозирования позволяет точно подобрать необходимое количество медикаментов, минимизируя риск передозировки и побочных эффектов. Постоянный мониторинг жизненно важных показателей дает возможность врачу корректировать схему лечения в режиме реального времени, что повышает безопасность и эффективность процедуры.

Получить дополнительные сведения – [url=https://vyvod-iz-zapoya-yaroslavl0.ru/]вывод из запоя на дому круглосуточно в ярославле[/url]

Портал для женщин https://beautyrecipes.kyiv.ua про гармонию и результат: здоровье, красота, стиль, саморазвитие, семья и отношения. Обзоры косметики и процедур, планы питания, тренировки, советы по дому и вдохновляющие истории. Всё в одном месте, 24/7.

Все обращения в клинику «РеабКузбасс» обрабатываются в рамках строгой анонимности. Пациент может проходить лечение без паспорта, под вымышленным именем, если это важно для психологического комфорта. Ни одна медицинская процедура или консультация не фиксируется в государственных базах без согласия. Персонал подписывает документы о неразглашении. Также предлагается анонимная оплата и оформление без упоминания диагноза в документах. При необходимости пациент может получить справку с нейтральной формулировкой для работы или страховой компании.

Изучить вопрос глубже – https://lechenie-narkomanii-novokuzneczk0.ru/lechenie-na-narkomani-czeny-novokuzneczk

EasyClickNeviron – Navigation smooth, content structured well, and checkout or actions straightforward.

online portal – Clear interface, minimal distractions, pages load quickly

Всё, что важно https://inclub.lg.ua женщине: здоровье и гормоны, питание и фитнес, стиль и гардероб, отношения и самооценка, уют и рецепты. Экспертные статьи, тесты и подборки. Сохраняйте любимое и делитесь — удобно на телефоне.

shopping site – The site feels modern, product range is okay, and checkout was quick.

Такой календарь делает весь процесс прозрачным: пациент видит логику, близкие — прогресс, а врач — чистый сигнал для коррекции без «эскалации на всякий случай».

Подробнее можно узнать тут – [url=https://narcologicheskaya-klinika-saratov0.ru/]частная наркологическая клиника в саратове[/url]

ideasbecomeforward access – Simple and effective design, fast loading pages, and smooth navigation

Медикаментозная терапия — важнейший этап стабилизации состояния. Врачи «СамарМед» применяют препараты с доказанной эффективностью: детоксикационные растворы, нейрометаболики, седативные и анксиолитические средства, ноотропы, гепатопротекторы, а при необходимости — антипсихотики. Подбор схемы проводится индивидуально, с учётом переносимости, наличия сопутствующих заболеваний, возраста и стадии зависимости. Все препараты применяются строго по международным протоколам и под контролем врачей круглосуточно.

Детальнее – [url=https://narkologicheskaya-klinika-samara0.ru/]вывод наркологическая клиника[/url]

Фармацевтическая индустрия переживает эпоху инноваций, когда качественные лекарственные препараты становятся доступными благодаря современным технологиям производства и строгому контролю. Компания Aprazer специализируется на поставках проверенных медикаментов, включая препараты для лечения вирусного гепатита С и онкологических заболеваний. Каждый продукт проходит многоступенчатую верификацию, что гарантирует его подлинность и эффективность. На платформе https://aprazer.com.ru/ представлен полный каталог с подробными описаниями, система мгновенной проверки подлинности через официальную базу данных и возможность получить консультацию русскоговорящих специалистов. Компания работает напрямую с производителями, обеспечивая стабильные поставки и защиту пациентов от контрафактной продукции на фармацевтическом рынке.

Эта последовательность помогает эффективно воздействовать на зависимость и исключает вероятность усугубления состояния.

Получить дополнительные сведения – http://lechenie-alkogolizma-perm0.ru

olvix – Well-structured pages, giving a solid first impression and easy to navigate

В наркологической клинике в Омске применяются только проверенные методы, эффективность которых подтверждена клинической практикой. Они помогают воздействовать на разные стороны зависимости и обеспечивают комплексный результат.

Подробнее – [url=https://narkologicheskaya-klinika-v-omske0.ru/]наркологическая клиника вывод из запоя в омске[/url]

Каждый метод подбирается индивидуально, что обеспечивает безопасность и эффективность процесса.

Углубиться в тему – [url=https://vyvod-iz-zapoya-omsk0.ru/]срочный вывод из запоя в омске[/url]

Многие сталкиваются с трудностями при выборе клиники или центра: предлагаемые услуги различаются по качеству, подходам, стоимости и длительности. Некоторые организации ограничиваются только медикаментозной поддержкой, не работая с глубинными причинами зависимости. Поэтому важно заранее понимать, какие параметры отличают действительно надёжное учреждение, способное обеспечить долгосрочные результаты.

Исследовать вопрос подробнее – https://lechenie-narkomanii-murmansk0.ru/czentr-lecheniya-narkomanii-marmansk

В клинике применяются комплексные программы, охватывающие все стадии терапии. Такой подход позволяет обеспечить пациенту полный спектр помощи — от первой консультации до социальной адаптации.

Детальнее – [url=https://narcologicheskaya-klinika-omsk0.ru/]наркологическая клиника цены в омске[/url]

После детоксикации пациенту назначается медикаментозная терапия, направленная на стабилизацию работы нервной системы и снижение тяги к наркотикам. Медикаменты подбираются индивидуально, учитывая особенности состояния каждого пациента.

Получить дополнительные сведения – https://lechenie-narkomanii-tver0.ru/tver-lechenie-alkogolizma

Current year strategies require crypto trading signals today adapting to 2026 market conditions. Providers adjusting for spot Bitcoin ETF maturity, evolving regulations, and institutional adoption demonstrate market awareness.

Confidentiality measures within best discreet hookup sites ensure security. Encrypted messaging, photo privacy controls, and discreet billing practices protect users valuing confidential exploration of casual relationships without social exposure risks.

Immediate delivery needs drive users to buy instant instagram likes for urgent campaigns. Fast fulfillment options enable rapid engagement for time-sensitive content requiring immediate social proof.

online retailer – Products are presented clearly, and search filters worked well.

Pelix Click – Pages responsive, navigation smooth and checkout worked without errors.

Ключевым фактором при выборе центра становится квалификация специалистов. Лечение алкоголизма — это не только выведение из запоя и купирование абстинентного синдрома. Оно включает работу с мотивацией, тревожными состояниями, семейными конфликтами, нарушением сна и другими последствиями зависимости. Только команда, включающая наркологов, психотерапевтов и консультантов по аддиктивному поведению, способна охватить все аспекты проблемы.

Подробнее можно узнать тут – [url=https://lechenie-alkogolizma-murmansk0.ru/]центр лечения алкоголизма мурманск.[/url]

Мы не используем универсальную «капельницу». Схема собирается из модулей под ведущие жалобы. Медицинские шаги всегда сочетаются с нефраком опорами — свет, тишина, вода малыми глотками, дыхание, — потому что среда усиливает действие препаратов и позволяет держать дозы ниже.

Углубиться в тему – [url=https://narkolog-na-dom-saratov0.ru/]вызов нарколога на дом[/url]

выпрямитель dyson купить [url=https://vypryamitel-dsn-kupit-4.ru/]выпрямитель dyson купить[/url] .

Funding rate monitoring for perpetual swaps informs best crypto signals leverage strategies. Extreme funding rates signal overheated positions and potential reversals.

Live session attendance improves when you buy instagram likes for announcement posts. Pre-live engagement generates interest driving attendance when broadcasts begin.

заказать сео анализ сайта пушка [url=https://seo-kejsy7.ru/]seo-kejsy7.ru[/url] .

Contemporary options among best free hookup sites 2026 demonstrate innovation. Free services incorporating modern features like video verification, AI matching, and enhanced safety compete effectively with paid alternatives.

Korla Direct – Navigation smooth, pages responsive and checkout steps simple to complete.

nolix source – Easy navigation and readable content that’s simple to understand

official shop – Discovered it randomly and thought it was worth saving.

дистанционное обучение 7 класс [url=https://shkola-onlajn13.ru/]дистанционное обучение 7 класс[/url] .

PrixoFlow – Fast-loading pages, organized design, and finding products straightforward.

Korva Web Link – Stumbled upon this and appreciated the fresh-looking content

Torix Point – Navigation simple, site intuitive, and shopping experience stress-free.

actioncreatesforwardpath web – Straightforward design, quick page loads, and overall readability is excellent

Во многих случаях пациент или его родственники не решаются сразу вызвать врача. Для таких ситуаций предусмотрена услуга онлайн-консультации. Она проводится через защищённую видеосвязь, при желании — анонимно. На связи — врач-нарколог или психиатр, который отвечает на вопросы, оценивает ситуацию по визуальным и вербальным признакам, рекомендует план действий. Консультация может стать отправной точкой для дальнейшего вызова врача на дом или записи в клинику. Это особенно удобно для родственников, которые не знают, как подступиться к проблеме и убедить человека в необходимости помощи.

Разобраться лучше – [url=https://narkologicheskaya-pomoshh-tver0.ru/]платная наркологическая помощь тверь[/url]

Platform-specific expertise makes best crypto signals telegram channels most effective. Telegram’s features including pinned messages, polls, and file sharing enhance signal delivery and community interaction.

Психотерапевтическая часть лечения строится на многоступенчатой программе. Вначале пациент учится понимать свои зависимости, выявлять скрытые мотивы употребления и работать с сопротивлением. На следующем этапе — формируется навык противостояния стрессу, прорабатываются внутрисемейные конфликты и создаются новые стратегии поведения. В финале — акцент на социализацию, возвращение к активной жизни, построение трезвого будущего. Используются как индивидуальные сессии, так и терапевтические группы, телемосты и онлайн-курсы.

Получить дополнительную информацию – [url=https://narkologicheskaya-klinika-samara0.ru/]наркологическая клиника нарколог[/url]

Political campaign involvement opportunities came after demonstrating ability to influence conversations. Campaign managers recruit digital advocates based on reach and engagement. I needed to buy twitter followers to contribute meaningfully to causes I care about through social advocacy.

Каждый из методов подбирается индивидуально, что позволяет учитывать медицинские показания и личные особенности пациента.

Получить дополнительные сведения – [url=https://lechenie-alkogolizma-perm0.ru/]центр лечения алкоголизма в перми[/url]

The job offers that came through Twitter connections exceeded opportunities found through traditional applications. Hiring managers discovered me through content and follower counts validated my expertise. When you buy twitter followers, you’re strengthening your professional brand in ways that attract better career opportunities.

check klyvo – Neat layout, easy-to-follow content, and a calm browsing experience

Наркологическая помощь в Новокузнецке представляет собой комплекс профессиональных медицинских мероприятий, направленных на диагностику, лечение и реабилитацию пациентов с алкогольной и наркотической зависимостью. В клинике «Альтернатива» помощь оказывается на всех этапах заболевания, что позволяет добиться стойких положительных результатов и восстановления качества жизни.

Разобраться лучше – [url=https://narkologicheskaya-pomoshh-novokuzneczk0.ru/]наркологическая помощь на дому новокузнецк[/url]

С момента начала лечения пациент получает доступ к круглосуточной линии поддержки. Врачи, психологи и координаторы готовы ответить на вопросы, помочь с корректировкой схемы лечения, поддержать в ситуации риска срыва. Эта функция особенно востребована в первые недели после выписки, когда человек сталкивается с триггерами в привычной среде и нуждается в дополнительной защите. Связь может осуществляться по телефону, через защищённый мессенджер или с помощью мобильного приложения клиники.

Узнать больше – [url=https://lechenie-narkomanii-samara0.ru/]лечение наркомании самара[/url]

Терапия в клинике проводится поэтапно, что позволяет обеспечить безопасность и прозрачность процесса. Пациент постепенно проходит все стадии восстановления организма и психики.

Изучить вопрос глубже – [url=https://narkologicheskaya-klinika-v-omske0.ru/]наркологическая клиника клиника помощь омск[/url]

Карта делает видимой причинно-следственную связь: пациент понимает, зачем и что именно делается; семья видит «точки проверки»; врач получает опору для изменения одного параметра без разрушения всего плана.

Подробнее можно узнать тут – [url=https://vyvod-iz-zapoya-saratov0.ru/]срочный вывод из запоя[/url]

link store – Smooth payment steps, confirmation email arrived very quickly.

Platform maturity changes growth dynamics. The days of easy organic reach are gone. Creators who buy tiktok likes and views are adapting to current realities where established accounts dominate visibility and new creators need strategic advantages to compete.

Zexaro Forge Point – Link opened fast, interface simple and content easy to follow.

The barrier to entry in digital marketing keeps rising. Audiences are more selective about who they follow. If you buy twitter followers to meet rising expectations, you’re adapting to market realities rather than stubbornly adhering to outdated strategies.

Туристический портал https://atrium.if.ua о путешествиях: направления, отели, экскурсии и маршруты. Гайды по городам и странам, советы туристам, визы, билеты и сезонность. Планируйте поездки удобно и вдохновляйтесь идеями круглый год.

Комплексное применение этих методов позволяет добиться быстрого восстановления организма и улучшения психоэмоционального состояния.

Получить дополнительные сведения – [url=https://vyvod-iz-zapoya-perm0.ru/]вывод из запоя клиника в перми[/url]

При получении заявки по телефону или через сайт администратор передаёт её врачу-дежуранту, который немедленно выезжает по указанному адресу. По прибытии специалист проводит первичный осмотр: измеряются артериальное давление, пульс, температура, сатурация. Затем осуществляется экспресс-оценка состояния ЦНС и метаболизма. При необходимости берутся анализы, подключается инфузионная система, проводятся противотревожные и детоксикационные мероприятия. Врач остаётся с пациентом до полной стабилизации состояния, а при тяжёлых симптомах организует транспортировку в стационар.

Получить дополнительную информацию – https://narkologicheskaya-pomoshh-tver0.ru/

marketplace – Information is organized, images match, and descriptions are easy to understand.

Zarix Online – Browsing fast, interface clear and product details simple to find.

После стабилизации состояния пациенту предлагается пройти этап реабилитации. В клинике он может занять от 30 до 180 дней, в зависимости от тяжести зависимости, стажа употребления и социальной ситуации. Реабилитационный блок построен по принципам когнитивной реструктуризации: меняются привычные модели мышления, формируются новые способы реагирования на стресс, прорабатываются неразрешённые психологические конфликты. Используются методы психодрамы, арт-терапии, телесно-ориентированной терапии и даже нейропсихологической гимнастики.

Разобраться лучше – [url=https://lechenie-narkomanii-samara0.ru/]лечение наркомании цена в самаре[/url]

Такая схема лечения делает процесс последовательным и контролируемым. Врачи клиники сопровождают пациентов на всех стадиях, помогая преодолеть как физическую, так и психологическую зависимость. Особое внимание уделяется возвращению человека к активной и стабильной жизни без употребления алкоголя или наркотиков.

Разобраться лучше – http://narkologicheskaya-klinika-v-izhevsk18.ru/narkologi-izhevsk-czeny/